Business Insurance UK – What Types of Coverage Do You Need?

If you own a business, you should make sure you’ve got the correct Business Insurance UK cover in place. This coverage includes: Employers’ liability, Public liability, Buildings and contents, and Business interruption. Depending on the nature of your business, you may need more than one type of insurance. Here’s a look at the basics of each.

Employers’ liability

Employers’ liability insurance is a legal requirement for any business with employees. It is not mandatory for family businesses that employ only family members. However, it is highly recommended, as it can give you peace of mind. The minimum amount of liability cover for employers is PS5 million. This type of insurance is available from a wide variety of insurers.

Employers’ liability insurance provides coverage for the expenses incurred by employees as a result of injuries, illness, or accidents caused by your business. This insurance will cover damages, legal defense costs, and any compensation awarded against your company in court.

Public liability

Public liability insurance for business can protect a business against the damages and injuries caused by third parties. It is often a legal requirement in certain trades, but it is also important for businesses that deal with the public. By purchasing public liability insurance for your business, you will be protecting yourself from the financial burden of third-party injury claims, property damage, and legal costs. In Australia, there are many companies that offer this type of policy. They include Calliden, QBE, and Vero.

Public liability insurance is important for any business. It protects your business against lawsuits due to injury or property damage that is caused by your business. Having this type of insurance is essential for protecting your company and your assets. In case of an accident, your public liability insurance will pay for any medical bills, legal costs, and compensation for the damages caused by the incident.

Buildings and contents

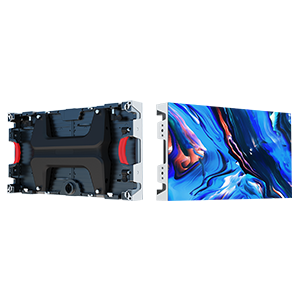

While buildings and contents insurance is a vital component of a business’s protection, there are many different types of coverage to choose from. For example, electronic equipment cover is designed to protect the portable equipment a business may own. While this type of cover isn’t necessary for business equipment, it is recommended for portable equipment.

Businesses can benefit from buildings and contents insurance because it covers the costs of repairing or replacing property or items in a building. Having the right insurance can help business owners sleep easier at night. It protects your premises, employees, and customers. You can even combine contents insurance with your existing commercial building insurance policy.

Business interruption

Business insurance for business interruption covers the loss of income that can occur following a disaster. This loss can include income that is lost during the rebuilding process of a damaged facility or because the business facility is shut down as a result of the disaster. It is a good way to protect your business against unexpected expenses.

In addition to covering the lost revenue, business interruption insurance will also cover operating expenses, such as rent, mortgage, lease, and payroll. In some cases, it will cover the costs of moving and training new employees.

Cyber cover

A comprehensive cyber insurance policy can protect your business against a variety of different threats. It will cover the costs of damages, claims, security failures, and breach response services, including the costs of restoring access to data. However, it won’t cover the cost of replacing equipment. However, this type of insurance can be invaluable for small businesses that rely on employees to access sensitive information.

A cyber attack can have severe implications for a business. In addition to the potential financial loss of a data breach, it could cause reputational damage and personal embarrassment. As a result, it is vital to secure your data with cyber insurance. You can start by comparing the various policies and comparing their costs. Cyber insurance is similar to other types of insurance, and will require you to pay a monthly premium. In the event of an attack, your policy will pay out, and most providers allow you to make claims from the moment of discovery.